Homeowners insurance is a necessary protection for any homeowner, but it can be particularly important for veterans and active service members. The right policy can protect you against a range of hazards, including floods and earthquakes. It also provides financial relief in the event of an accident on your property or a theft of valuables.

Military homeowners' insurance provides unique discounts and benefits for active and retired military members, their spouses, and children. Many of these policies include additional coverage, including uniforms or other personal items that are lost or stolen while in war zones.

USAA has become a favorite among veterans and their families. You can purchase its policies online in all states. AM Best gave it an A++ financial strength rating and offered a wide range of discounts and coverage options.

Lemonade was founded in 2008, but has already earned a reputation for being an affordable insurance option for homeowners. The company uses artificial intelligence when writing its policies. This can reduce the cost of premiums. It also offers an incentive program where unused insurance premiums are donated to support organizations for military members, veterans, and their family.

GEICO provides a 15% discount for homeowners who are veterans. This discount is offered to all active duty and National Guard military members, retirees, and National Guard reserve members. It also offers special deployment discounts for those who are in danger of being deployed.

Armed Forces Insurance is a popular option for veterans and members of the military. Since 1887 it has been serving military families. It also offers optional endorsements that allow you to customize your coverage.

AFI offers military-specific discounts on home insurance as well as auto, business renters and pet policies. The rates of AFI are comparable to other top insurance providers, and the company provides many options for coverages that will ensure you have the protection you require.

USAA Farmers and Liberty Mutual also offer policies and discounts tailored for military personnel. The criteria for determining eligibility changes periodically, so be sure to check with an agent to confirm what you're eligible for.

USAA

While many homeowners insurance companies don't provide special discounts for military members, USAA has a long history of serving those who have served in the United States armed forces. Its standard home insurance plans include uniform and war zone coverage, along with replacement cost coverage for personal possessions.

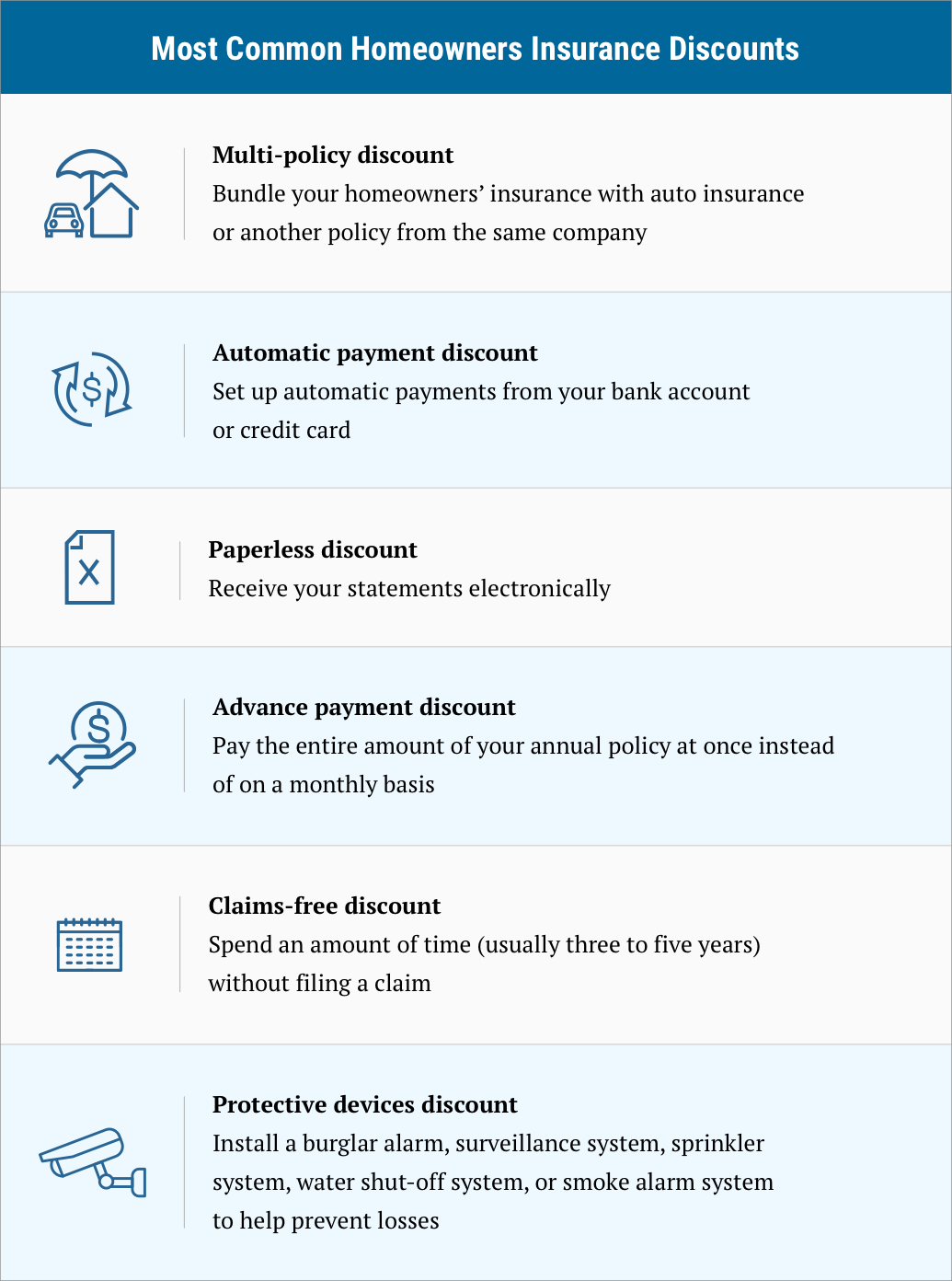

USAA offers a range of discounts, including bundled home and auto policies, for military families. USAA offers a no claims policy for pre-commissioned and military officers.

Finding the right homeowners policy for military members or veterans can be difficult, but finding a plan that suits you and your family is possible. Here are some tips that will help you choose the right policy for your budget and needs.