Understanding the different factors that affect home insurance is vital. This means that shopping around for the best price on your policy can help you save money while still getting the coverage you need.

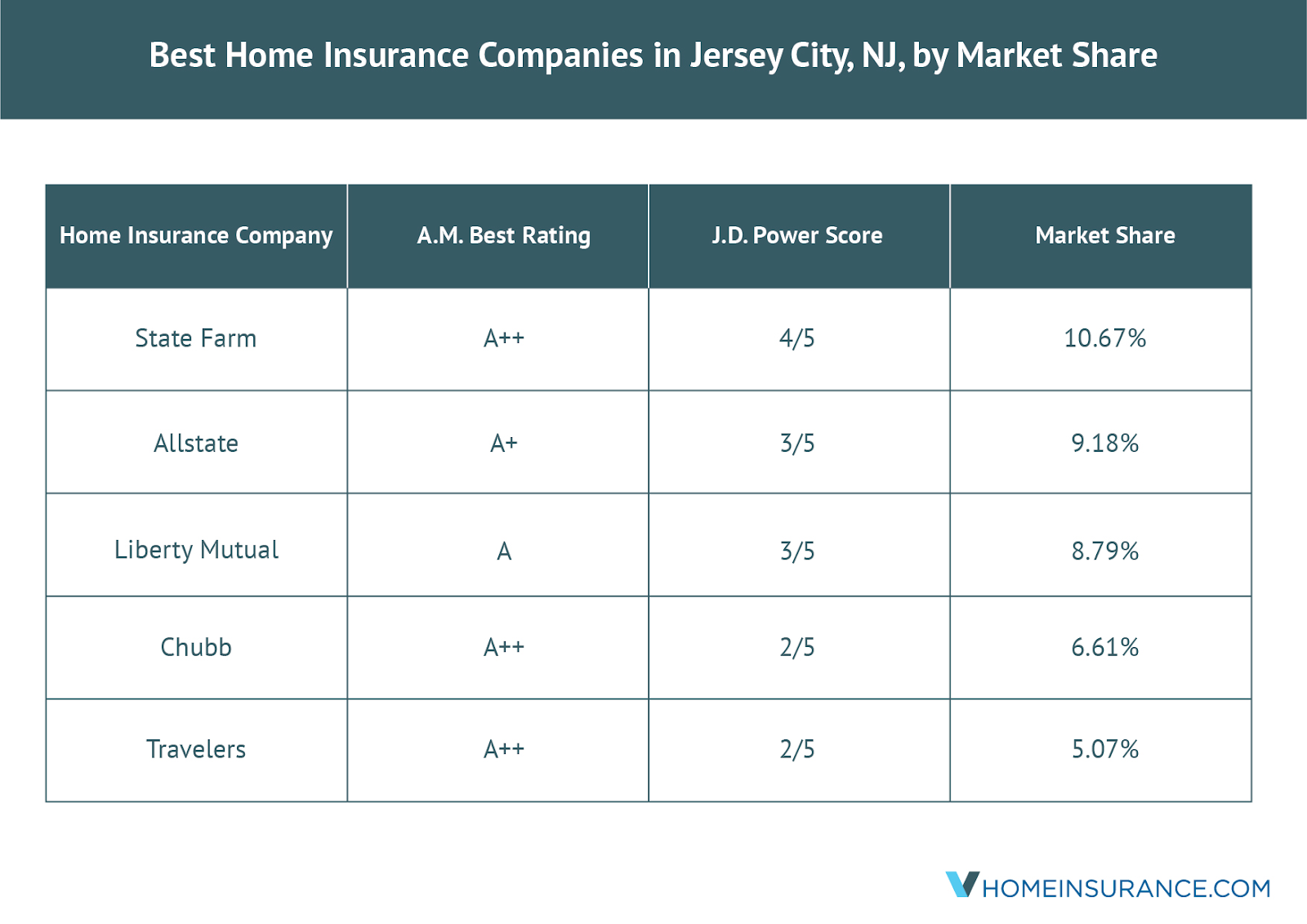

Start by checking the average rates of different homeowners' insurance companies in your locality. This information can be found on the website of your state insurance department. You can get a good idea of how much home insurance costs in your area by checking the website of the state's insurance department. However, rates will vary widely from company to company as insurers weigh rating factors differently.

Your deductible

Home insurance deductibles are important to the coverage that you select, just like health insurance and auto insurance. The deductible affects how much you have to pay for any claims or problems, like broken windows or leaking pipes. A low deductible increases your premium, whereas a high one can lower it.

Your zip code

The zip code of your home has a direct effect on the price you pay for home insurance. You'll pay more for home insurance if your neighborhood is one that is susceptible to burglaries. As well, those areas more susceptible to natural disasters such as earthquakes and hurricanes will be more costly.

Local fire protection

You could qualify for a lower rate of insurance if there is a nearby fire station. Home security systems and alarms are examples of safety features that can lower your insurance rates.

Home improvement is a great way to improve your home.

Adding more value to your home through remodeling or adding additional rooms can make your house less likely to be damaged during a disaster, which can save you money on your policy. You can add a new bedroom or a kitchen to your home.

You may also see a difference in your rate based on what type of property you own, and the age. Older houses are more likely to suffer from flood and fire damage.

The frequency with which you make a claim or file one will also influence your quote. Insurance companies will give you a lower quote if they know you've suffered a series of small losses.

Please read the fine print in your policy

There will be differences in the deductibles offered by each insurance company, along with their limits and categories of coverage. All companies try to maximize their profits, so they offer a variety of coverage options to appeal to a wide range of customers.

The fine print may seem daunting, but is well worth the time because it helps to clarify what coverage your policy provides and what doesn't. It will help you determine if you want to include more specialized protection and endorsements on your policy in order for it to be better protected against certain perils.

You can ask your agent for help. You can ask your agent to explain the various options and any discounts available to you.